The Ultimate Hedge: How Commercial Solar Protects Your Business from Energy Price Volatility

As a business leader, you meticulously plan your budget, manage supply chains, and strategize for growth. Yet, one of the largest and most unpredictable line items in your operating expenses remains largely outside of your control: your electricity bill. This constant threat of **energy price volatility** can derail forecasts, erode profits, and create a significant drag on your company’s financial stability.

But what if you could transform that unpredictable liability into a stable, predictable asset? In 2025, thousands of businesses are doing just that by deploying commercial solar not just as an environmental initiative, but as a powerful financial instrument. This guide will explain exactly how solar acts as a long-term **hedge against energy price volatility**, giving you control over one of your most critical operating costs and building a more resilient, competitive business.

The Problem: Why Your Business’s Energy Bill is a Ticking Time Bomb

Before exploring the solution, it’s essential to understand the problem. The price your business pays for electricity isn’t arbitrary; it’s the result of a complex and often turbulent global market.

What is Energy Price Volatility?

Energy price volatility refers to the frequent and significant fluctuations in the price of electricity. One month, your bill might be manageable; the next, a price spike could blow a hole in your budget. This uncertainty makes long-term financial planning incredibly difficult and exposes your business to unnecessary risk.

The Key Drivers: Geopolitics, Weather, and Grid Strain

Why are prices so unstable? According to the U.S. Energy Information Administration, a variety of factors influence electricity prices.

- Fuel Costs: The price of natural gas is a primary driver of electricity prices in many regions. Geopolitical events, supply chain disruptions, or changes in demand can cause natural gas prices to skyrocket, taking your electricity bill with them.

- Extreme Weather: Heatwaves, deep freezes, and other severe weather events increase demand for heating and cooling, straining the grid and causing sharp, short-term price spikes.

- Grid Infrastructure: An aging grid and the complex transition to new energy sources can create bottlenecks and reliability issues, all of which contribute to price instability.

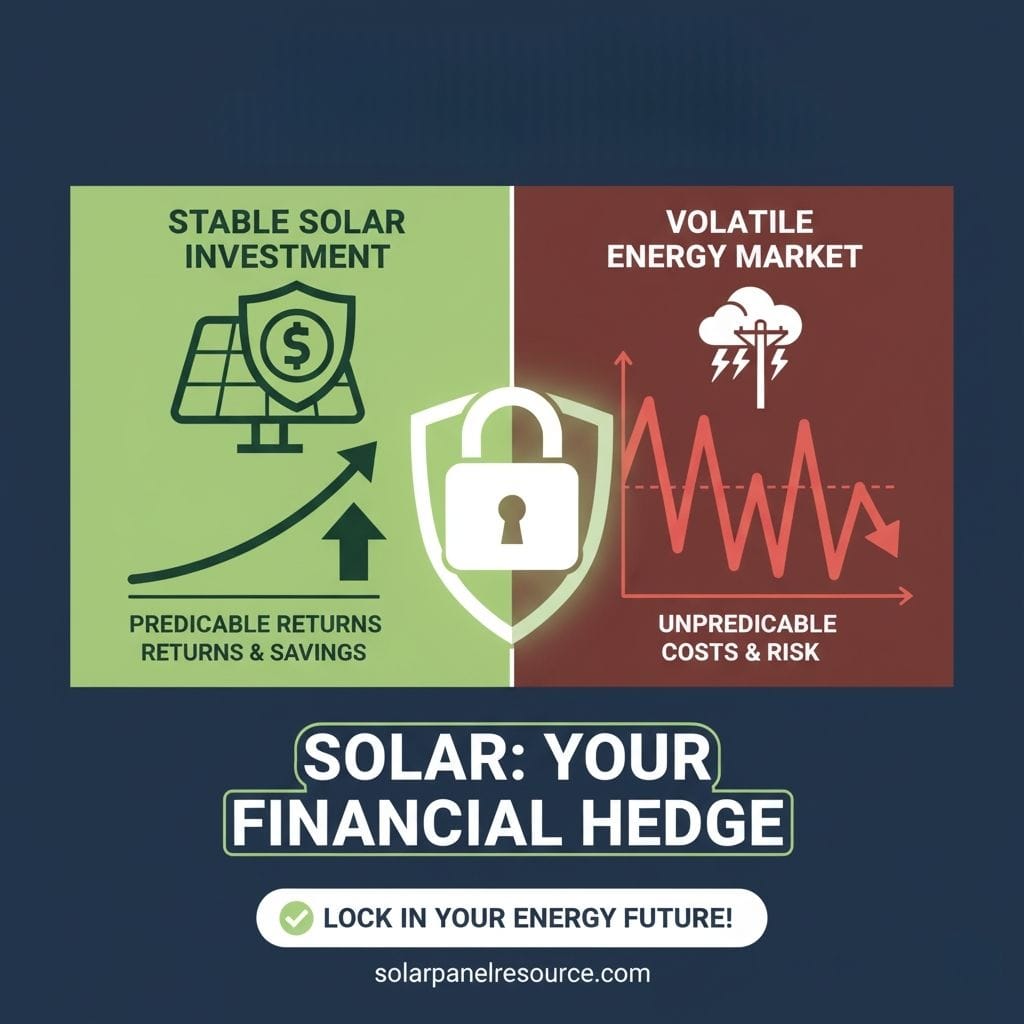

Introducing the Solution: Solar as a Financial Hedging Tool

In finance, a “hedge” is an investment made to reduce the risk of adverse price movements in an asset. Commercial solar is one of the most effective physical hedges a business can deploy against the volatile cost of electricity.

This financial strategy has a measurable return, which you can explore with our solar panel ROI calculator.

The Fixed-Rate Mortgage Analogy for Energy

Think of buying power from the utility like renting a house with a variable-rate lease. Your monthly payment can change at any time based on market conditions, leaving you with no long-term certainty.

Investing in a solar system is like buying that house with a fixed-rate mortgage. You lock in your housing (or in this case, electricity) costs for the next 25-30 years. You know exactly what you’ll be paying every month, regardless of what happens in the chaotic “rental” market outside. This is the essence of budget certainty.

Moving Electricity from a Variable OpEx to a Fixed Asset

By generating your own power onsite, you are fundamentally changing your accounting. You are converting a volatile, unpredictable operating expense (OpEx) into a predictable, fixed asset on your balance sheet. This asset produces a “dividend” every day in the form of clean, fixed-cost electricity.

How Solar Creates Budget Certainty: A Practical Breakdown

The stability provided by solar isn’t just a concept; it’s a calculable financial metric.

Calculating Your Levelized Cost of Energy (LCOE)

The Levelized Cost of Energy (LCOE) is a crucial calculation. It represents the total lifetime cost of your solar system divided by its total lifetime energy production. The result is a fixed price per kilowatt-hour (kWh) that you can compare directly to the utility’s variable rate. For most commercial projects in 2025, the LCOE of solar is significantly lower than the price of grid electricity.

Scenario: A Manufacturing Plant’s Energy Costs – Before and After Solar

Imagine a manufacturing plant that uses 500,000 kWh per year.

* **Before Solar (Unhedged):** At an average utility rate of $0.15/kWh, their annual cost is $75,000. But due to volatility, this could swing wildly between $65,000 and $90,000 from year to year, making budgeting a nightmare. * **After Solar (Hedged):** They install a solar system that covers 80% of their usage (400,000 kWh) with an LCOE of $0.06/kWh. Their annual solar cost is now a fixed $24,000. They only buy 100,000 kWh from the grid, reducing their exposure to volatility by 80%. Their total energy cost becomes more stable and predictable year after year.

The Mechanics of the Hedge: Which Solar Financing Model is Right for You?

You can achieve price stability through different financing structures, each with its own benefits.

You can achieve price stability through different structures, and our guide comparing a solar loan vs. a lease vs. a PPA can help you choose.

Direct Ownership: The Ultimate Long-Term Hedge

When you purchase the solar system (with cash or a loan), you achieve the lowest possible LCOE and the most complete hedge. You own the asset, reap all the production benefits, and are entitled to all tax incentives. This path offers the highest return on investment and the most robust protection against volatility.

Solar Power Purchase Agreement (PPA): A Zero-Cost Hedge with a Fixed Rate

In a PPA, a third party owns and maintains the solar system on your roof. You simply agree to buy the power it produces at a fixed, predetermined rate that is lower than the utility’s price. While you don’t get the tax benefits, you get immediate savings and **fixed electricity costs** with zero upfront capital investment. It’s a fantastic option for businesses that want to hedge without a large capital outlay.

Quantifying the Risk: What Happens if You *Don’t* Hedge Against Volatility?

Remaining fully exposed to the volatile energy market is a significant financial risk.

Case Study: The Impact of a 20% Price Spike on an Unhedged Business

Let’s go back to our unhedged manufacturing plant paying $75,000 annually. If a geopolitical event or a severe heatwave causes a sustained 20% spike in electricity rates, their annual energy cost suddenly jumps to $90,000. That’s a $15,000 unplanned expense that directly hits their profit margin. The solar-powered competitor, however, would barely feel this impact, as 80% of their power is locked in at a low, fixed rate.

Long-Term Competitive Disadvantage

Businesses that lock in low energy costs with solar gain a fundamental competitive advantage. They can price their goods and services more competitively or enjoy higher profit margins than their unhedged rivals who are constantly battling unpredictable energy bills.

Common Misconceptions About Solar as a Hedge

Myth: “Solar means I’m completely off-grid.”

Reality: For nearly all commercial applications, the solar system remains connected to the utility grid. The grid provides power at night and during periods of low solar production. The goal of the hedge isn’t to eliminate the grid, but to minimize your financial exposure to its price volatility.

Myth: “The hedge is only as good as the weather.”

Reality: Solar production is highly predictable over the long term. While output varies day-to-day, annual production estimates are incredibly accurate. Financial models are based on these reliable long-term averages, not on whether it will be sunny next Tuesday.

FAQ

How does solar help with “demand charges” on my bill?

Demand charges are based on your peak power usage. While solar alone helps, pairing solar with a battery storage system is the most effective way to hedge against demand charges. The battery can discharge during peak hours, lowering your demand from the grid and slashing those fees.

How long does the solar “hedge” last?

A commercial solar system is built with equipment warrantied for 25 to 30 years. Your hedge against volatility is effective for the entire operational lifespan of the system.

Is a PPA or Direct Ownership a better hedge?

Both are effective hedges against volatility. Direct ownership provides a more complete hedge and higher ROI if your company has the capital and tax appetite. A PPA is a better hedge for businesses that want to avoid upfront costs while still locking in a predictable, lower rate for energy.

Solar Energy Enthusiast & Renewable Energy Researcher

Vural’s journey into solar energy began four years ago, driven by frequent power outages and high electricity bills at his own home. He has since gained hands-on experience with both personal and commercial solar projects. At solarpanelresource.com, Vural shares his real-world insights and in-depth research to guide homeowners and business owners on their own path to energy independence.