Solar Panel ROI Calculator 2025: The Key Variables That Impact Your Payback

Making the switch to solar energy is one of the most significant financial decisions a homeowner or business owner can make. It’s not just an environmental choice; it’s a long-term investment. But like any investment, the critical question is: what’s the return? As we move into 2025, understanding your solar panel ROI is more crucial than ever. The landscape of energy costs, government incentives, and technology is constantly shifting.

This comprehensive guide is designed to demystify the process. We will break down every critical factor that a reliable solar panel ROI calculator 2025 uses to determine your payback period. Forget vague estimates. Here, you’ll find the concrete variables and data-driven insights you need to confidently assess whether going solar is the right financial move for you.

Understanding Solar Panel ROI: More Than Just a Number

Before diving into complex calculations, it’s essential to grasp what “Return on Investment” truly means in the context of solar energy. It’s a measure of the profitability of your solar panel system over its lifetime, comparing your total savings and earnings against your total costs.

What is Solar ROI and Why Does it Matter in 2025?

Solar ROI tells you how much money your solar panel system will save or earn you relative to its initial cost. It is typically expressed as a percentage. A high ROI means your system is not only paying for itself but also generating significant financial returns. In 2025, with volatile electricity prices and evolving incentives, calculating an accurate ROI is the only way to get a clear picture of the solar panel cost vs savings and make an informed decision.

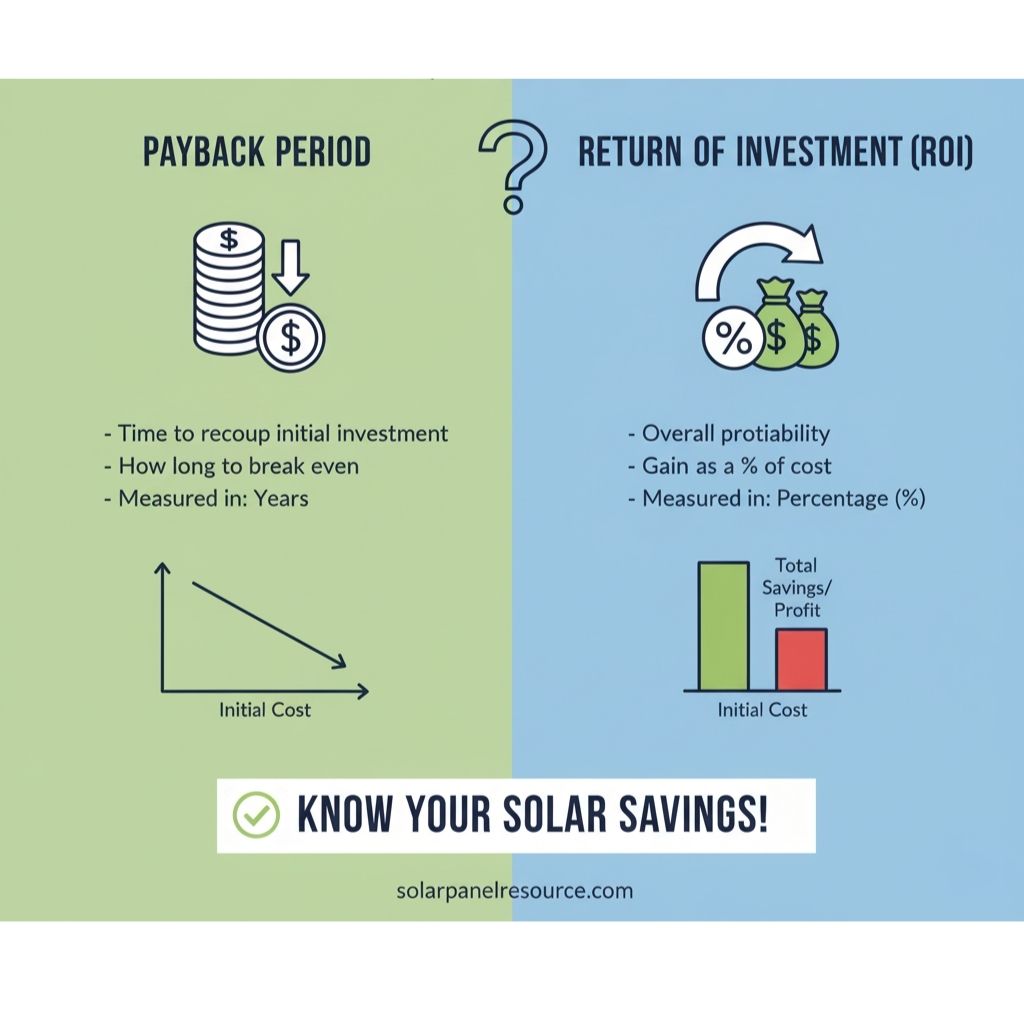

Payback Period vs. Return on Investment: A Quick Clarification

People often use these terms interchangeably, but they are different metrics:

- Payback Period: This is the amount of time (in years) it takes for your cumulative energy savings to equal your initial investment. After this point, every kilowatt-hour your panels produce is pure profit.

- Return on Investment (ROI): This is the total profit you’ll make over the system’s lifespan (typically 25-30 years), expressed as a percentage of the initial cost. It provides a more complete view of the investment’s long-term value.

For most homeowners, the solar panel payback period is the more intuitive and immediate concern, so we will focus heavily on the variables that influence it.

The Core Formula: How to Calculate Your Solar Panel Payback Period

At its heart, the calculation is straightforward. You need to know how much you paid and how much you save each year. A basic formula gives you a starting point for understanding how any solar panel ROI calculator works.

The Simple Payback Formula

The fundamental formula for the simple payback period is:

Payback Period (in years) = (Total System Cost – Total Incentives) / Annual Solar Savings

Let’s break down those components:

- Total System Cost: The gross price of the panels, inverters, racking, labor, and permitting.

- Total Incentives: The sum of all federal, state, and local rebates or tax credits you receive.

- Annual Solar Savings: How much you save on your electricity bill each year by using solar power instead of grid power.

A Real-World Example

Imagine a homeowner in Arizona installs a 6kW solar system.

- Total System Cost: $18,000

- Federal Tax Credit (30%): $5,400

- Net System Cost: $18,000 – $5,400 = $12,600

- Average Monthly Electric Bill Before Solar: $150

- Average Monthly Electric Bill After Solar: $20

- Monthly Savings: $130

- Annual Solar Savings: $130 x 12 = $1,560

Using the formula: $12,600 / $1,560 = 8.07 years. In this scenario, the system pays for itself in just over 8 years. For the remaining 17+ years of the panel’s warranty, the homeowner enjoys nearly free electricity.

The Key Variables: What Every Solar Panel ROI Calculator Considers in 2025

The simple calculation above is a great start, but a truly accurate solar ROI projection requires a deeper look at numerous influencing factors. These are the key variables that sophisticated calculators analyze.

1. Gross System Cost: The Upfront Investment

This is your starting number. The cost of a solar installation depends on the system size (measured in kilowatts, kW), the quality of the panels and inverters, and local labor rates. The average cost in the U.S. hovers around $3.00 per watt before incentives.

2. Electricity Rates: Your Biggest Savings Driver

The higher your utility’s electricity rate (measured in cents per kilowatt-hour, kWh), the faster your payback period will be. If you pay a high price for grid electricity, each kWh your panels generate saves you more money. This is the single most important variable in the solar panel cost vs savings equation.

3. Government Incentives & Tax Credits: Slashing Your Initial Cost

Incentives are a massive factor in solar viability. The most significant is the federal Residential Clean Energy Credit, often called the Investment Tax Credit (ITC). According to the U.S. Department of Energy, this credit allows you to deduct a percentage of the cost of installing a solar energy system from your federal taxes. You should always check for the most current information from an authoritative source like the official energy.gov website. Beyond the federal level, many states, municipalities, and even utility companies offer their own rebates, tax credits, or performance-based incentives (like SRECs).

4. Solar Panel Production & Efficiency

How much energy will your system actually produce? This depends on several factors:

- Sunlight Exposure (Insolation): A home in sunny California will generate more power than one in overcast Seattle.

- Panel Orientation and Tilt: South-facing roofs with a tilt angle of around 30 degrees are typically optimal in the Northern Hemisphere.

- Shading: Trees or nearby buildings can significantly reduce output.

- Panel Efficiency: Higher-efficiency panels produce more power per square foot but come at a premium cost.

5. System Degradation: A Slow and Steady Decline

Solar panels don’t last forever. Their ability to produce power slowly decreases over time—a process called degradation. Most high-quality panels come with a performance warranty guaranteeing they will still produce at least 80-90% of their original output after 25 years. A standard degradation rate used in many calculators is 0.5% per year. A good calculator will factor this gradual decline into long-term savings projections.

6. Operating and Maintenance (O&M) Costs

While solar panels are remarkably low-maintenance, they aren’t zero-maintenance. Potential costs include periodic cleaning (especially in dusty areas) and the eventual replacement of the inverter, which typically has a shorter warranty (10-15 years) than the panels themselves. Factoring in a small annual budget for O&M (around 0.5% – 1% of the system cost) provides a more realistic ROI.

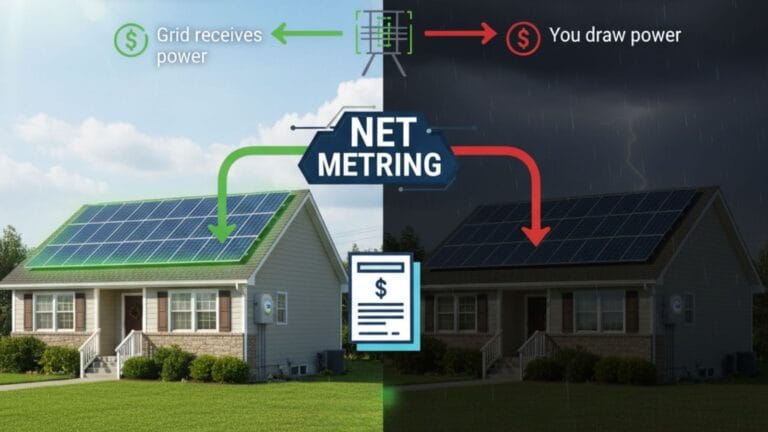

7. Net Metering and Solar Buy-Back Rates

Your system will often produce more electricity than you can use during peak sunny hours. Net metering is a utility policy that credits you for this excess energy, which you can then draw from the grid at night. The value of these credits is critical. Some utilities offer a 1-to-1 retail rate, while others have moved to “avoided cost” rates, which are significantly lower and can extend your payback period.

8. Your Property’s Value: The Long-Term Gain

Multiple studies have shown that homes with solar panels sell for more than comparable homes without them. While this doesn’t affect your payback period in terms of energy savings, it’s a crucial part of the overall financial return and should be considered in your decision-making process.

Deep Dive: Analyzing the Impact of Each Variable

Understanding the list of variables is one thing; appreciating their real-world impact is another. Let’s explore how some of these factors can dramatically alter your solar panel payback period.

How Location Drastically Changes Your ROI

Location is a master variable because it influences several other factors simultaneously:

- Sunlight: Arizona gets far more peak sun hours than Vermont.

- Electricity Rates: States like California and Massachusetts have very high electricity costs, making solar more attractive.

- Incentives: State and local incentives vary wildly. A state with strong local rebates on top of the federal ITC will have a much shorter payback time.

This is why a generic online calculator isn’t enough. You need one that uses location-specific data to provide a meaningful estimate.

The Critical Role of the Federal Solar Tax Credit (ITC) in 2025

The federal ITC is a game-changer. For a system costing $20,000, a 30% credit means a $6,000 reduction in your net cost, directly slashing years off your payback period. It is essential to confirm your eligibility and understand that it’s a nonrefundable tax credit, meaning you must have sufficient tax liability to take full advantage of it. The existence of this credit is one of the primary reasons is solar worth it in 2025 is often answered with a resounding “yes” for many people.

State and Local Incentives: Don’t Leave Money on the Table

Beyond the federal credit, you might be eligible for Solar Renewable Energy Certificates (SRECs), cash rebates, or state tax credits. In some states, these additional incentives can cut another 10-20% off your net cost. Ignoring them can lead to a significant miscalculation of your true ROI.

Misconception Corner: Are Maintenance Costs a Deal-Breaker?

A common fear is that unexpected maintenance costs will derail the financial benefits of solar. In reality, modern solar panel systems are incredibly reliable. They have no moving parts and require minimal upkeep. The most significant future cost is a potential inverter replacement after 10-15 years. When this predictable cost is factored into a 25-year ROI calculation, it has a relatively small impact on the overall profitability.

Using an Online Solar Panel ROI Calculator: A Step-by-Step Guide

Armed with this knowledge, you can now effectively use an online tool. Here’s how to approach it for the most accurate results.

Gathering the Right Information

To get a precise estimate, have the following details ready:

- Your Average Monthly Electricity Bill: Look at your last 12 months of utility bills to find the average.

- Your Utility Provider’s Name: The calculator needs this to find your electricity rate and net metering policy.

- Your Address: This is used to assess sunlight exposure (insolation) and roof orientation using satellite imagery.

- An Estimate of System Cost: If you don’t have a quote yet, you can use the national average of around $3.00 per watt.

Interpreting the Results: Look Beyond the Payback Number

A good calculator will provide more than just a single number. Look for a detailed breakdown that shows:

- 25-Year Savings: The total projected savings over the system’s life.

- Internal Rate of Return (IRR): A more advanced metric that many financial analysts prefer over simple ROI.

- Environmental Impact: The CO2 emissions you’ll offset, often equated to trees planted or cars taken off the road.

Is Solar a Good Investment in 2025? The Final Verdict

For the vast majority of homeowners and business owners in areas with decent sunlight and average-to-high electricity rates, solar panels remain an excellent investment in 2025. The payback period can often be under 10 years, leaving over 15 years of warrantied, free electricity.

Weighing the Financial Pros and Cons

Pros:

- Significant reduction or elimination of your electricity bill.

- Protection against future utility rate hikes.

- Strong long-term ROI, often exceeding traditional investments like stocks.

- Increases your property value.

- Generous government incentives reduce the initial cost.

Cons:

- High upfront cost, even with incentives.

- ROI is highly dependent on location and local policies.

- Potential for future maintenance costs (e.g., inverter replacement).

- Not suitable for all homes (e.g., heavy shading, old roofs).

Beyond ROI: The Intangible Benefits of Going Solar

While this article focuses on the financial calculation, the benefits of solar extend beyond your bank account. Energy independence, reducing your carbon footprint, and contributing to a more stable and resilient power grid are powerful motivators that add unquantifiable value to your investment.

What is a good ROI for solar panels?

A “good” ROI is subjective, but most financial experts consider a solar investment with a payback period of 8-12 years to be very strong. This often translates to an annualized ROI of 8-12% or more, which is better than many traditional market investments.

How has the cost of solar panels changed?

Over the last decade, the cost of solar panel installation has dropped dramatically, by over 50%. While prices have stabilized and even slightly increased in the early 2020s due to supply chain issues, the overall trend remains highly favorable for consumers.

Can I calculate my solar ROI without a professional?

Yes, you can get a very good preliminary estimate using a high-quality online solar panel ROI calculator 2025. However, for a fully binding quote and a precise analysis that includes a physical inspection of your roof and electrical system, you will need to consult with a reputable solar installer.

Do solar panels increase home value in 2025?

Yes. Numerous studies from sources like Zillow and the Lawrence Berkeley National Laboratory have consistently shown that homes with owned solar panel systems sell faster and for a premium compared to those without. This added value is a significant, often overlooked, part of your total return on investment.

“The average cost in the U.S. hovers around $3.00 per watt, but to get a complete breakdown, see our full guide on how much solar panels cost in 2025.”

Solar Energy Enthusiast & Renewable Energy Researcher

Vural’s journey into solar energy began four years ago, driven by frequent power outages and high electricity bills at his own home. He has since gained hands-on experience with both personal and commercial solar projects. At solarpanelresource.com, Vural shares his real-world insights and in-depth research to guide homeowners and business owners on their own path to energy independence.