Solar Loan vs. Lease vs. PPA: A 2025 Comparison for Maximum Savings

The decision to go solar is a significant step towards energy independence and long-term savings. However, the path to a solar-powered home isn’t a one-size-fits-all journey. One of the most critical choices you’ll face is how to finance your system. With rising interest rates and evolving market conditions in 2025, understanding your options—solar loans, leases, and power purchase agreements (PPAs)—is more important than ever. Each option offers a different path, with unique benefits and drawbacks that directly impact your total costs, long-term savings, and system ownership.

This comprehensive 2025 guide will demystify the complexities of solar financing. We’ll provide an expert, neutral analysis of each option, helping you compare them side-by-side. Our goal is to empower you to make an informed decision that aligns with your financial goals, property ownership aspirations, and a desire to maximize your solar savings.

The Three Main Solar Financing Options

At a high level, solar financing can be broken down into two main categories: ownership and third-party ownership. A solar loan is a form of ownership, while leases and PPAs fall under the third-party ownership model. The fundamental difference lies in who holds the title to the solar equipment on your roof.

1. Solar Loans: The Path to Ownership

A solar loan is the most common way to pay for a system without a large upfront cash payment. Much like a mortgage or a car loan, you borrow money from a bank, credit union, or a specialized solar lender to buy the system outright. You then make fixed monthly payments over a set period (typically 10-25 years) until the loan is paid off. Once the loan is settled, you own the system free and clear, and your electricity is essentially free.

Pros of a Solar Loan:

- Full Ownership: You own the system from day one. This gives you complete control over your energy production and allows you to add components like a solar battery at any time.

- Access to Incentives: As the system owner, you are the only one who can claim the valuable 30% Federal Solar Tax Credit. For a typical system, this can be a saving of thousands of dollars. You also qualify for any state and local rebates or Solar Renewable Energy Credits (SRECs) that are tied to ownership.

- Highest Long-Term Savings: While you have a monthly loan payment, you are also building equity and eventually eliminating your electricity bill entirely. Over the system’s 25+ year lifespan, a solar loan typically provides the highest financial return on investment (ROI) compared to a lease or PPA.

- Increased Home Value: A solar system that you own adds significant value to your property. Studies consistently show that homes with owned solar panels sell for a premium and often sell faster than comparable non-solar homes.

Cons of a Solar Loan:

- Financial Commitment: A solar loan is a long-term debt that must be paid back. Interest rates, while often lower than other consumer loans, still add to the total cost of the system.

- Credit Requirement: To secure a good interest rate and favorable terms, you need a strong credit score.

- Maintenance Responsibility: As the owner, you are responsible for any maintenance, cleaning, or repairs. While solar panels are very low-maintenance, a part like the inverter may need replacement after 10-15 years, a cost that falls on you.

- Dealer Fees: Some “no-money-down” solar loans offered by installers come with high dealer fees, which can be as high as 30% of the loan amount. This fee is often hidden in the total loan amount and can negate the benefit of a low interest rate. It’s crucial to compare the cash price of the system to the financed price.

For many homeowners, a solar loan is the ideal choice. It provides the financial accessibility of a loan while allowing them to reap all the long-term benefits of ownership, including the substantial solar tax credit.

2. Solar Leases: The “Rent-to-Save” Model

A solar lease is a popular third-party ownership option where a solar company installs a system on your roof and, in return, you pay a fixed monthly “rent” for the use of the equipment. You do not own the solar panels. The company owns, operates, and maintains the system for the duration of the lease agreement, which typically spans 20 to 25 years.

Pros of a Solar Lease:

- Zero or Low Upfront Cost: The most significant advantage of a solar lease is that it requires little to no money down. This makes solar energy accessible to homeowners who don’t have the cash for an outright purchase or the credit for a loan.

- Hassle-Free Maintenance: The leasing company is responsible for all maintenance, repairs, and performance monitoring. If a panel stops working, it is their responsibility to fix it, providing you with peace of mind.

- Predictable Monthly Payments: Your monthly lease payment is typically a fixed amount, making it easy to budget for. The payment is often designed to be less than your previous utility bill, providing immediate savings.

- Immediate Savings: You start saving money on your electricity bill from the very first month, with no need to wait for a tax return or for the system to pay for itself.

Cons of a Solar Lease:

- No Ownership or Incentives: You do not own the system. This is a critical point. Because the leasing company is the owner, they are the ones who claim the federal solar tax credit and any other ownership-based incentives. You lose out on this major financial benefit.

- Lower Long-Term Savings: While you save money compared to your utility bill, you will continue to have a monthly payment for the entire 20-25 year term. With an owned system, your payments eventually end, and your savings become pure profit. Over the system’s life, a lease offers a significantly lower ROI.

- Complications with Home Sales: A solar lease is a contract tied to your property. When you sell your home, the new owner must either take over the lease or buy the system outright. This can complicate and even deter potential buyers who don’t want to assume a long-term contract.

- Payment Escalators: Many lease agreements include an annual payment escalator, typically 1-3%. This means your monthly payment will increase each year, cutting into your long-term savings.

A solar lease is best suited for homeowners who do not have a strong enough credit score for a loan or have no federal tax liability to benefit from the tax credit. It provides a simple, low-risk way to benefit from solar energy without the responsibilities of ownership.

3. Power Purchase Agreements (PPAs): Paying for Power, Not Panels

A PPA is a financing option very similar to a solar lease, but with a key difference in how you pay. Under a PPA, a third-party company owns, installs, and maintains the solar panels, but you don’t pay a fixed monthly fee. Instead, you agree to buy the electricity produced by the solar panels at a predetermined rate per kilowatt-hour (kWh), often lower than your local utility’s rate.

Pros of a PPA:

- No Upfront Cost: Like a lease, a PPA requires no initial investment, making solar accessible to a wide range of consumers.

- Immediate Savings: You start saving money from day one because the price you pay for solar energy is cheaper than your utility’s electricity rate.

- No Maintenance Responsibility: The PPA provider is responsible for all maintenance, monitoring, and repairs. This is a significant benefit, as you can enjoy the benefits of clean energy without any of the hassle.

- Performance-Based Payment: Your payments are based directly on how much electricity the system produces. If the sun doesn’t shine much in a given month, your PPA bill will be lower. This can be more appealing than a fixed lease payment.

Cons of a PPA:

- No Ownership or Incentives: Just like with a lease, you do not own the system. The PPA provider claims all tax credits, rebates, and other financial incentives. This loss of incentives can be a major disadvantage.

- Fluctuating Bills: While a lease offers a fixed payment, your PPA bill will fluctuate based on your energy consumption and how much power the system generates. This can make monthly budgeting more difficult.

- Escalator Clauses: Most PPAs have a fixed rate that increases annually by a small percentage (e.g., 2.9% per year). While this is often less than the annual increase in utility rates, it still means your cost for solar power will rise over time, limiting your total long-term savings.

- Complications with Home Sales: Like a lease, a PPA can complicate the sale of your home. The agreement is tied to the property, and the new homeowner must either assume the contract or buy the system, which can be a deal-breaker for some.

A PPA is a good option for homeowners who prefer a no-upfront-cost approach and are comfortable with a variable monthly bill that’s tied to their energy usage. It’s a way to go solar without the responsibilities of ownership, but it comes at the expense of long-term financial benefits.

2025 Side-by-Side Comparison for Maximum Savings

To help you decide, here is a detailed comparison of the three options. The “best” choice is subjective and depends entirely on your financial situation, goals, and risk tolerance.

| Feature | Solar Loan | Solar Lease | Solar PPA |

|---|---|---|---|

| Ownership | Yes, from day one. | No, the company owns it. | No, the company owns it. |

| Upfront Cost | Low to zero. | Zero or very low. | Zero. |

| Qualifies for 30% Tax Credit | Yes. You claim the credit. | No. The company claims the credit. | No. The company claims the credit. |

| Impact on Home Value | Increases property value. | Can complicate a home sale. | Can complicate a home sale. |

| Monthly Payment | Fixed. Payments end when the loan is paid off. | Fixed (but may have an escalator). Payments never end. | Variable, based on energy production. |

| Maintenance & Repairs | Homeowner’s responsibility. | Company’s responsibility. | Company’s responsibility. |

| Long-Term Savings | Highest. | Moderate. | Moderate. |

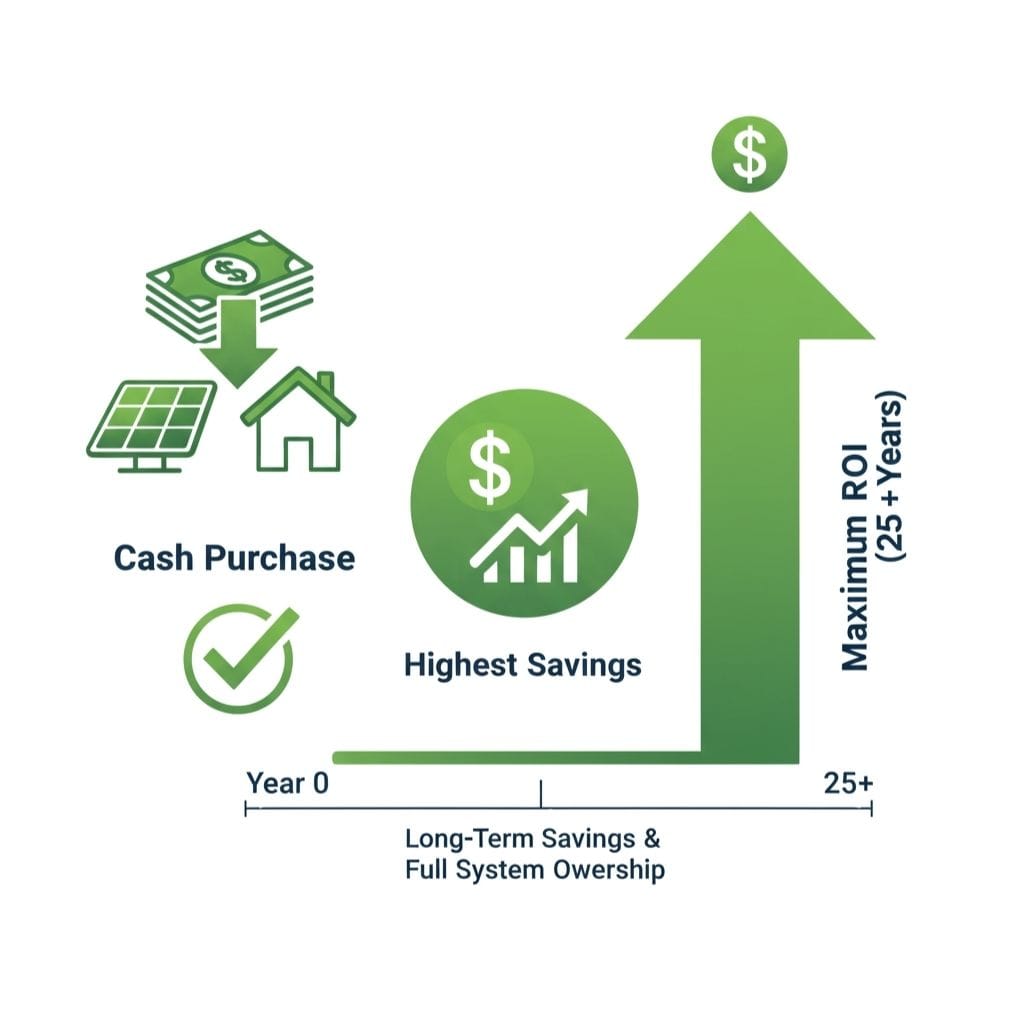

Cash Purchase: The Best Option for Maximum ROI

While this article focuses on financing options, it’s essential to briefly mention a fourth option: a cash purchase. If you have the financial means, paying for your solar system upfront with cash will give you the highest possible return on investment. You avoid all interest payments and financing fees. You also gain immediate access to all incentives, and once the system’s payback period is over (typically 6-10 years), the electricity is truly free for the rest of the system’s 25+ year lifespan.

This is the gold standard for maximizing savings, but it’s not a realistic option for most homeowners due to the high upfront cost. For those with a significant amount of cash or a home equity line of credit (HELOC), a cash purchase can be the most rewarding path.

According to the U.S. Department of Energy’s SunShot Initiative, the average residential solar system pays for itself in just 7-10 years, making it one of the most reliable and safe long-term investments a homeowner can make. This payback period is even shorter with a cash purchase and the full benefit of incentives. For a deeper dive into the economics, you can explore the Homeowner’s Guide to Solar Financing from the Department of Energy.

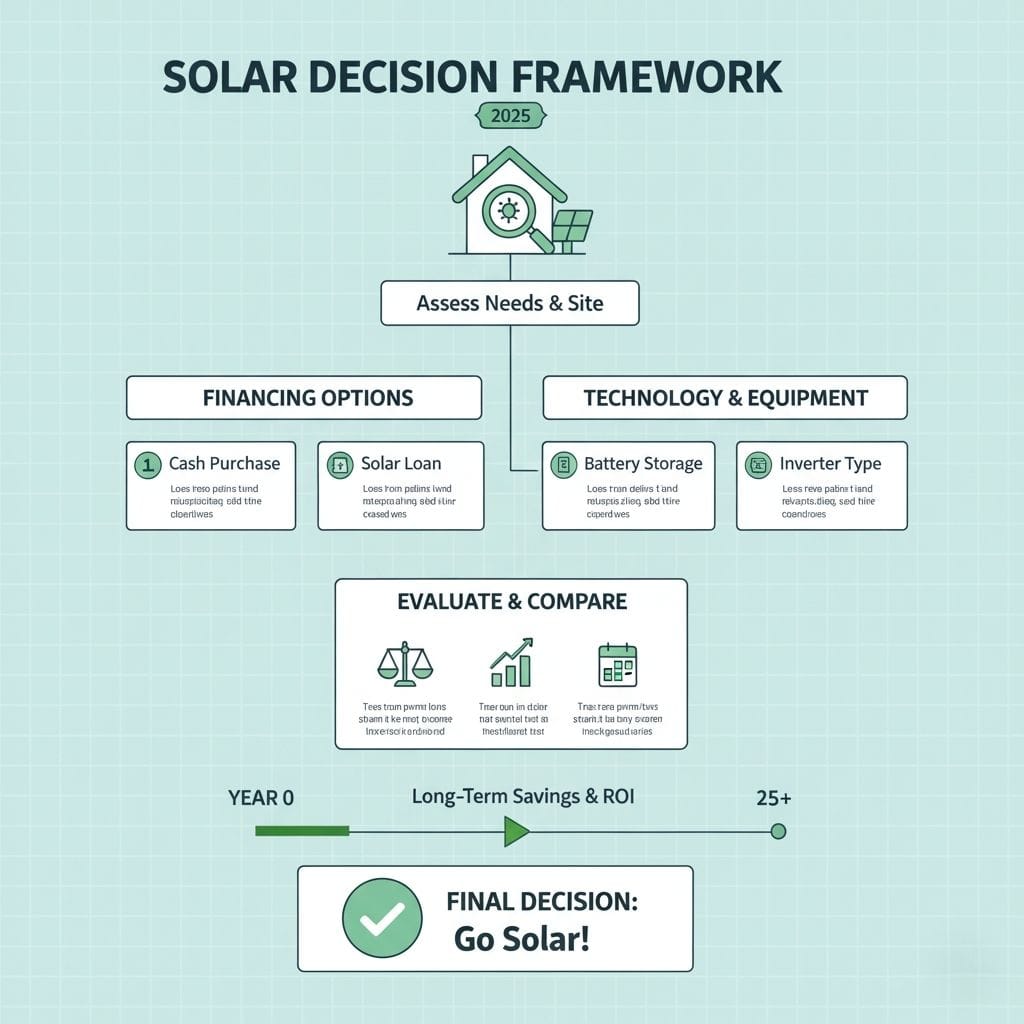

Your Decision-Making Framework for 2025

Choosing the right financing option requires a careful assessment of your personal circumstances. Here is a simplified framework to help you decide which path is right for you in 2025:

Choose a Solar Loan If:

- You want to own your system and are eligible for a good interest rate.

- You have enough federal tax liability to benefit from the 30% solar tax credit.

- You want to maximize your long-term savings and property value.

- You are comfortable with the responsibility of maintenance, though it is minimal.

Choose a Solar Lease or PPA If:

- You want to install solar with little or no money down.

- You don’t have enough federal tax liability to use the tax credit, or you prefer to have a lower monthly payment in exchange for the company claiming the credit.

- You do not want the responsibility of owning and maintaining the system.

- You are not concerned with the long-term ROI and are more focused on immediate, predictable savings on your utility bill.

In conclusion, while leases and PPAs offer a convenient entry point into solar energy, the numbers are clear: solar loans and cash purchases provide the greatest long-term financial benefits. The benefits of system ownership—including the full value of the federal tax credit, increased home value, and the eventual elimination of a monthly energy payment—make it the superior choice for those who are able to pursue it. The key for 2025 is to start your research now, compare all your options thoroughly, and choose the one that puts you on the best path to maximizing your savings for decades to come.

Is a Solar Loan Better Than a Lease?

For most homeowners, yes. A solar loan allows you to own the system, which qualifies you for the federal solar tax credit and leads to significantly higher long-term savings and a better return on investment. A lease, while offering no upfront cost, gives all these benefits to the leasing company.

Can I Get a Solar PPA with a Battery?

Yes, many PPA providers now include solar batteries in their offerings. However, as you do not own the system, the battery is also part of the PPA, and you do not qualify for the tax credit on its cost.

What Happens at the End of a Solar Lease or PPA?

At the end of a long-term lease or PPA, you typically have three options: renew the contract, have the company remove the panels, or buy the system at its fair market value.

Do Solar Loans Come with a Warranty?

The loan itself does not. However, the solar panels and inverters you purchase with the loan come with a manufacturer’s warranty, usually covering the equipment for 25+ years.

Solar Energy Enthusiast & Renewable Energy Researcher

Vural’s journey into solar energy began four years ago, driven by frequent power outages and high electricity bills at his own home. He has since gained hands-on experience with both personal and commercial solar projects. At solarpanelresource.com, Vural shares his real-world insights and in-depth research to guide homeowners and business owners on their own path to energy independence.