How to Find and Apply for Solar Incentives and Rebates in the US?

The decision to go solar is a major financial investment, but the initial price tag you see is almost never the price you’ll actually pay. A powerful and complex web of solar incentives and rebates exists specifically to lower the cost and accelerate your return on investment. The challenge? These programs vary dramatically by state, city, and even utility company.

Navigating this landscape can feel overwhelming, but it’s the single most important step to maximizing your solar savings. This guide is your roadmap. We’ll break down the different types of incentives, show you exactly how to find solar incentives in your state, and walk you through the general application process. By understanding this system, you can slash the true cost of your solar panel installation by thousands, or even tens of thousands, of dollars.

Why Solar Incentives are a Game-Changer for Your ROI

When you get a quote from a solar installer, you’re looking at the “gross cost.” This is the total price of the hardware, labor, and permits. Solar incentives are designed to attack this number from multiple angles, leading to a much lower “net cost,” which is your actual out-of-pocket expense.

The Difference Between Gross Cost and Net Cost

Think of it like buying a new car. The sticker price is the gross cost. But after a manufacturer’s rebate, a dealer discount, and a trade-in, the amount you actually finance or write a check for is the net cost. Solar incentives work the same way, turning a significant investment into a financially savvy one. The goal is to make your net cost as low as possible, which in turn dramatically shortens your payback period.

The Hierarchy of Solar Incentives: From Federal to Hyper-Local

The best way to understand solar savings is to visualize them as a layered cake. Each layer represents a different level of government or organization offering a unique benefit. Your goal is to get a slice of every layer available to you.

- The Federal Layer: This is the broad, foundational layer available to all eligible U.S. taxpayers.

- The State Layer: This layer varies widely and includes some of the most powerful incentives.

- The Local/Utility Layer: This is the most specific layer, offering rebates and grants from your city, county, or specific electric company.

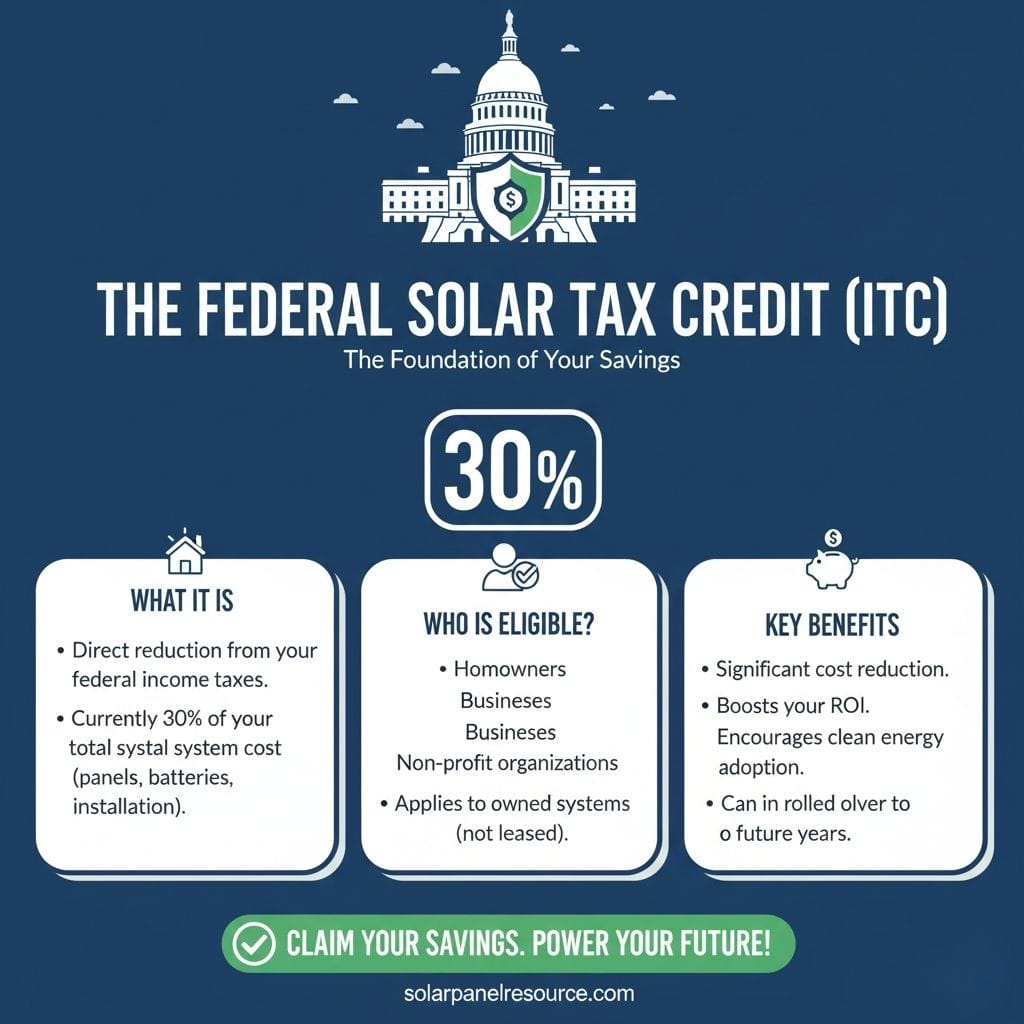

Layer 1: The Federal Solar Tax Credit (ITC) – The Foundation of Your Savings

The most significant and well-known solar incentive is the federal Residential Clean Energy Credit, commonly known as the Investment Tax Credit or ITC. This is the cornerstone of solar affordability in the United States.

What is the ITC in 2025?

For systems installed in 2025, the ITC allows you to claim a credit worth 30% of the total cost of your solar energy system. This is not a deduction, but a dollar-for-dollar credit against your federal income taxes. If your system costs $25,000, you are eligible for a $7,500 tax credit, reducing your net cost to $17,500 right off the bat.

Who is Eligible for the Federal Tax Credit?

To be eligible, you must own your solar panel system (cash or loan purchase) and have enough tax liability to claim the credit. If you lease your system or sign a Power Purchase Agreement (PPA), the third-party owner claims the credit, not you. The credit can also be used for solar battery storage systems when charged by your solar panels.

How to Apply for the ITC (IRS Form 5695)

Claiming the credit is a relatively straightforward part of filing your annual taxes. You or your tax professional will need to complete and attach IRS Form 5695, Residential Energy Credits, to your federal tax return for the year the system was installed and placed in service.

“Claiming the credit is a relatively straightforward part of filing your annual taxes; our step-by-step guide on how to claim the 30% federal tax credit walks you through the entire process.”

Layer 2: State Solar Incentives – Where Your Location Really Matters

This is where the incentive landscape begins to diverge. State-level programs are designed to meet specific regional clean energy goals and can make a good investment in one state an incredible one in another. Here are the most common types of state solar incentives.

State Tax Credits: Doubling Down on Savings

Some states offer their own tax credits on top of the federal ITC. For example, a state might offer a credit of 10% of the system cost, up to a certain limit (e.g., $1,000). This would be a separate credit applied to your state income taxes, further reducing your tax bill and overall project cost.

Cash Rebates: Instant Price Reductions

These are straightforward, upfront rebates that are often administered by state-sponsored clean energy organizations. A state might offer a rebate calculated on a per-watt basis (e.g., $0.20 per watt). For a 6,000-watt system, this would be an instant $1,200 cash back, paid either to you or directly to your installer (who then passes the savings to you).

Solar Renewable Energy Certificates (SRECs): A Market for Your Green Energy

In certain states, you earn one SREC for every 1,000 kilowatt-hours (kWh) or 1 megawatt-hour (MWh) of electricity your solar system produces. Utilities are required by law to purchase these SRECs to meet their renewable energy mandates. This creates an ongoing revenue stream for you, as you can sell your SRECs on an open market for years after your installation.

Layer 3: Local and Utility Company Solar Rebates – Don’t Overlook These Gems

The most overlooked savings are often the most local. These programs are smaller in scale but can provide a welcome boost to your project’s economics.

Municipal & County Programs

Some cities or counties offer their own grants or rebates to residents who go solar. These are often targeted programs with specific eligibility requirements and limited funding, so acting quickly is key.

Utility Company Rebate Programs

Your specific electric provider may offer a one-time rebate for installing solar panels. They do this to encourage distributed generation, which can help reduce strain on the grid during peak demand hours. Check your utility’s website for “solar programs” or “renewable energy incentives.”

The Ultimate Tool: How to Find Every Incentive in Your State

Keeping track of all these programs would be nearly impossible without a centralized resource. Fortunately, one exists, and it’s the gold standard for renewable energy policy information.

Introducing the DSIRE Database

The Database of State Incentives for Renewables & Efficiency (DSIRE) is a comprehensive, publicly available database of all clean energy incentives in the United States. It’s operated by the N.C. Clean Energy Technology Center at N.C. State University and is the most authoritative resource you can use. You can access it here: www.dsireusa.org.

A Step-by-Step Guide to Using DSIRE

- Go to the Website: Navigate to the DSIRE homepage.

- Select Your State: Click on your state on the interactive map of the U.S.

- Filter the Results: On the state page, you’ll see a long list of policies. Use the filter options on the left. Under “Technology,” select “Solar.” Under “Program Type,” you can select specific incentives like “Rebate Program” or “Personal Tax Credit.”

- Review Each Program: Click on the individual program links to read detailed summaries, including eligibility requirements, incentive amounts, and, most importantly, a link to the official program website and contact information for the program administrator.

The Application Process: A General Step-by-Step Guide

Knowing the incentives is half the battle; applying for them is the other. While each program has its own unique process, the general workflow is similar.

Step 1: Pre-Installation Research and Reservation

Many popular rebate programs have limited funds that are allocated on a first-come, first-served basis. It’s crucial to check program websites for funding status. Some programs require you to “reserve” your rebate before installation begins.

Step 2: Work with Your Installer (Crucial Step)

Your solar installer is your most valuable partner in this process. Reputable installers are experts on the local incentives and will handle the majority of the paperwork on your behalf. They will factor all eligible incentives into your final contract and manage the application submissions.

Step 3: Gathering Documentation

You’ll need to provide documents like your utility bill, proof of homeownership, and the final signed contract. Your installer will need technical spec sheets for the panels and inverters being used.

Step 4: Post-Installation Submission and Inspection

Once the system is installed, the final application packet is submitted. Some programs may require a separate inspection to verify the installation meets their standards before the incentive is paid out.

Common Misconceptions and Pitfalls to Avoid

Navigating incentives requires careful attention to detail. Here are common mistakes to avoid.

- Myth: “All incentives are guaranteed.” Reality: Rebate programs can and do run out of money. Always check the funding status.

- Myth: “I can apply after my system is installed.” Reality: Many programs require pre-approval or a reservation before you sign a contract or begin work.

- Myth: “The savings are instant cash.” Reality: Tax credits are non-refundable and only apply if you have tax liability. Rebates can take weeks or months to be processed and paid out.

Beyond Direct Savings: Other Valuable Solar Policies

In addition to direct financial incentives, several policies make going solar more affordable.

- Property Tax Exemptions: Many states will not count the value added by your solar panels toward your property taxes, saving you hundreds of dollars per year.

- Sales Tax Exemptions: Some states waive the sales tax on solar equipment, saving you 5-10% on the total hardware cost upfront.

- Net Metering: This policy allows you to get credit on your electric bill for the excess electricity your panels send back to the grid. It is the single most important policy for long-term solar savings.

Can I use both federal and state tax credits?

Yes, absolutely. State tax credits are applied to your state tax liability, and the federal ITC is applied to your federal tax liability. They do not conflict with each other.

Does my solar installer handle all the rebate paperwork?

In most cases, yes. A good, full-service installer will manage the entire application process for all known state and local rebates as part of their service. Always confirm this when you are getting quotes.

How do I find out if my utility company offers a solar rebate?

The best way is to check the DSIRE database. You can also visit your utility company’s website directly and search for “solar,” “renewables,” or “rebates.”

Are solar incentives available for businesses too?

Yes. Businesses can claim the federal ITC and are often eligible for even more aggressive incentives, like accelerated depreciation (MACRS), that can significantly improve the financial returns of a commercial solar project.

Solar Energy Enthusiast & Renewable Energy Researcher

Vural’s journey into solar energy began four years ago, driven by frequent power outages and high electricity bills at his own home. He has since gained hands-on experience with both personal and commercial solar projects. At solarpanelresource.com, Vural shares his real-world insights and in-depth research to guide homeowners and business owners on their own path to energy independence.