How to Find and Apply for Solar Incentives and Grants in Europe (2025 Guide)

Across Europe, the drive towards clean energy has never been stronger. Fuelled by ambitious climate goals and a desire for energy independence, governments at every level are rolling out a vast array of solar incentives and grants. For homeowners and businesses, this presents a golden opportunity. The price you see on a solar panel quote is rarely the final price you pay.

Navigating the diverse support schemes of over 27 different countries can seem daunting. However, understanding how to find and apply for these benefits is the key to unlocking a fantastic return on your investment. This guide will serve as your compass, explaining the types of support available, showcasing examples from major European countries, and providing a clear strategy to find every solar grant and subsidy available in your specific region.

Why Solar Incentives are Crucial for Europe’s Green Transition

Solar incentives do more than just save you money; they are a critical policy tool for achieving the ambitious targets set by the European Green Deal and the REPowerEU plan. By making solar financially irresistible, governments accelerate the transition away from fossil fuels, enhance energy security, and empower citizens to become active participants in the energy market.

For you, the benefit is direct: these programs dramatically reduce the upfront cost of solar panels and shorten the time it takes for the system to pay for itself, a period known as the payback period.

These programs dramatically reduce the upfront cost… which is one of the key variables in our solar panel ROI calculator.

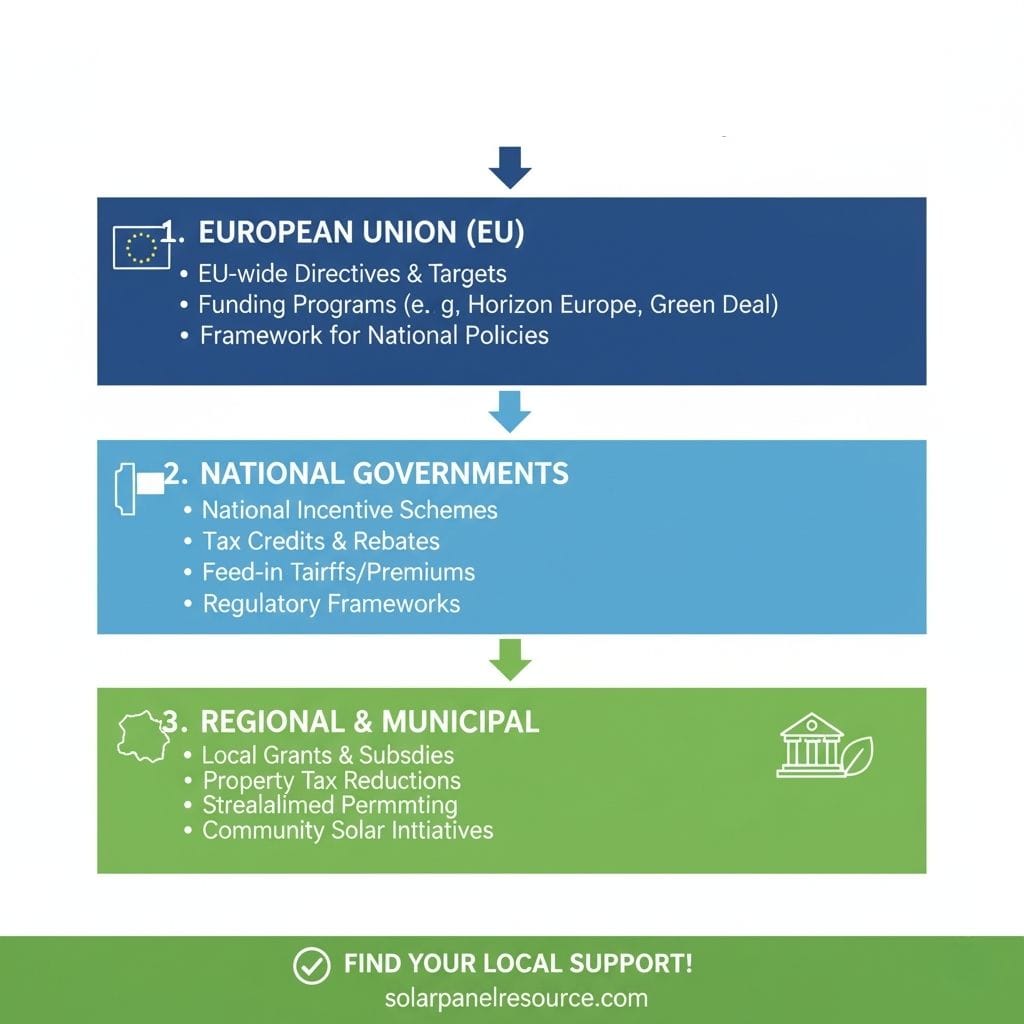

The Layers of European Solar Support: From Brussels to Your Municipality

It’s helpful to think of European solar support as a multi-layered cake. Each layer represents a different level of governance, and your goal is to take advantage of every layer available to you. The exact “flavours” of the cake will differ by country, but the structure is generally consistent.

- The EU Layer: Broad directives and funding mechanisms that set the stage for national action.

- The National Layer: The most significant layer, containing the core grants, tax breaks, and energy payment schemes for your country.

- The Regional/Municipal Layer: Highly specific, local incentives that can provide an extra financial boost.

Pan-European Support: EU-Level Initiatives & Funding

While the European Union doesn’t typically offer direct grants to individual homeowners, its policies create a highly favourable environment for solar investment across the continent.

The EU Green Deal & REPowerEU Plan

These landmark EU policies mandate that member states aggressively expand renewable energy. This political pressure is the primary driver behind the generous national incentive programs. The REPowerEU plan, in particular, has made solar energy a top priority, leading many countries to simplify permitting and enhance financial support. According to the European Commission, these initiatives are central to making Europe the first climate-neutral continent.

Value-Added Tax (VAT) Reductions

One of the most powerful EU-driven incentives is the ability for member states to apply a reduced or even zero-rate VAT on the supply and installation of solar panels. Many countries, including Germany, the Netherlands, and others, have already implemented a 0% VAT rate for residential solar. This alone can cut the total cost of your project by up to 20% or more, depending on your country’s standard VAT rate.

National-Level Solar Incentives: The Core of Your Savings

This is where you will find the most impactful financial support. National governments are the main source of direct solar panel grants and subsidies. While the names change from country to country, the mechanisms generally fall into these categories:

1. Feed-in Tariffs (FiTs): Guaranteed Prices for Your Power

A Feed-in Tariff is a policy where the utility company is obligated to buy the solar electricity you export to the grid at a fixed, above-market rate for a set period (e.g., 20 years). This provides a predictable, long-term revenue stream, guaranteeing your investment. While some countries are phasing out traditional FiTs, they are still active in many forms.

2. Investment Grants & Subsidies: Upfront Cost Reduction

This is the most direct form of support. It’s a straightforward grant that covers a percentage of your installation costs or offers a fixed sum. The money is often paid out after the installation is complete and approved, directly reducing your net investment.

3. Tax Credits & Deductions: Lowering Your Tax Burden

Similar to the US system, many European countries offer tax incentives. This could be a tax credit that directly reduces your income tax bill or a tax deduction that allows you to deduct the cost of the solar installation from your taxable income over several years, which is especially common for businesses.

4. Net Metering & Self-Consumption Schemes

Under a **net metering** scheme, your electricity meter runs backwards when you export power to the grid, effectively allowing you to trade your excess solar energy for grid energy at a 1:1 ratio. Many countries are moving towards “self-consumption” models, where you receive a bonus or premium for the energy you generate and consume yourself, plus a separate, lower payment for exported energy.

A Look at Key European Countries (Examples for 2025)To illustrate how these policies work in practice, let’s look at a few major solar markets:

- Germany: A solar powerhouse, Germany offers reduced FiT payments through its Renewable Energy Sources Act (EEG). More importantly for new buyers, it provides low-interest loans and investment grants through the KfW bank, alongside the 0% VAT on residential systems.

- Spain: Focusing heavily on self-consumption, Spain offers rebates funded by the EU’s NextGenerationEU programme. Additionally, many municipalities offer significant reductions on property tax (IBI) and construction tax (ICIO) for homeowners who install solar.

- France: The main support mechanism is the “prime à l’autoconsommation” (self-consumption premium), a grant paid out over five years. France also offers a guaranteed FiT for any excess energy sold to the grid and the popular “MaPrimeRénov'” grant for holistic home energy upgrades, which can include solar.

- The Netherlands: The famous “salderingsregeling” (net metering) scheme is a huge driver of solar adoption, allowing homeowners to offset their energy purchases with their solar production directly. This scheme is planned to be gradually phased out, but it remains highly beneficial for now.

How to Find Every Solar Incentive in Your Country

Your search for incentives should be systematic. Follow these steps to ensure you don’t miss any opportunities.

- Start with Your National Energy Agency: Every EU country has a national body responsible for energy policy and renewables. Their website is the most reliable source for information on nationwide grants, FiTs, and tax policies. Search for “[Your Country] national energy agency” or “[Your Country] solar incentives.”

- Check Your Regional and Municipal Government Websites: After understanding the national picture, drill down to your local level. Your province, state (Länder), or municipality (commune) may offer additional grants. Search for “solar grants [Your City Name].”

- Consult with Certified Local Installers: This is a crucial step. Reputable, certified solar installers are experts on the local incentive landscape. They deal with the application processes daily and are your best resource for navigating the bureaucracy. They will factor all available subsidies into their final quote.

The Application Process in Europe: A General Guide

While specifics vary, the application journey typically follows this path:

- Step 1: Initial Consultation and Quote: Your installer designs a system and provides a quote that clearly outlines the gross cost, all eligible incentives, and the final net cost.

- Step 2: Submitting the Grant/Subsidy Application: CRITICAL! For most investment grants, the application must be submitted and often approved *before* you sign the final contract or begin installation. Your installer will usually handle this.

- Step 3: Grid Connection Application: Your installer will submit a technical application to your local electricity grid operator (DSO) to get permission to connect the system.

- Step 4: Installation and Commissioning: Once all approvals are in place, the system is installed. Afterwards, a final report and inspection are often required to release the grant payment or activate your FiT contract.

Do I need a special certification for my installer?

Yes, almost certainly. Most European grant and subsidy programs require that the system be installed by a nationally certified professional (like an MCS certification in the UK or a local equivalent) to be eligible for funding. Never use an uncertified installer if you want to receive incentives.

Are solar incentives available for businesses?

Absolutely. Businesses often have access to an even wider range of support, including accelerated depreciation on the asset, larger investment grants, and special tax considerations. The principles of finding and applying for them remain the same.

Can incentive programs run out of money?

Yes. Many national and regional grant programs operate with a fixed annual budget. They are often allocated on a first-come, first-served basis. This is why it’s critical to act promptly once you decide to move forward.

What’s the difference between a feed-in tariff and net metering?

A feed-in tariff pays you a specific, often premium, price for every unit of electricity you export. Net metering lets you “trade” your exported electricity for grid electricity at the same retail price, effectively making the grid your battery. Both are beneficial, but the financial calculations work out differently.

Solar Energy Enthusiast & Renewable Energy Researcher

Vural’s journey into solar energy began four years ago, driven by frequent power outages and high electricity bills at his own home. He has since gained hands-on experience with both personal and commercial solar projects. At solarpanelresource.com, Vural shares his real-world insights and in-depth research to guide homeowners and business owners on their own path to energy independence.