How to Claim the 30% Federal Solar Tax Credit in 2025: A Step-by-Step Guide

Going solar is one of the most powerful financial decisions you can make for your home or business. Beyond saving money on your utility bills, the federal government offers a major financial incentive to make the transition even more affordable: the Federal Solar Tax Credit, also known as the Residential Clean Energy Credit or the Investment Tax Credit (ITC). For 2025, this credit allows you to deduct a full 30% of your solar installation costs from your federal tax bill.

This comprehensive, step-by-step guide will walk you through everything you need to know about the 2025 solar tax credit. From eligibility requirements and qualified expenses to the exact form you need to file, we’ll demystify the process and help you maximize your savings. Our goal is to provide you with the expert, trustworthy information you need to confidently claim your credit and accelerate your solar investment.

Understanding the Federal Solar Tax Credit in 2025

The Federal Solar Tax Credit is a non-refundable tax credit. This means it directly reduces the amount of income tax you owe, dollar for dollar. It is not a rebate or a direct payment, so you must have a tax liability to take full advantage of it. For example, if you owe $5,000 in federal taxes and have a $3,000 solar tax credit, your tax bill drops to $2,000.

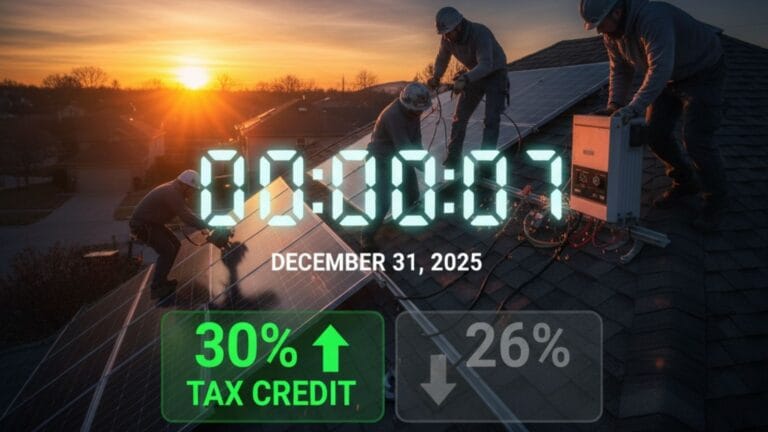

What is the 2025 Solar Tax Credit Percentage?

For solar energy systems placed in service between 2022 and 2032, the federal tax credit is 30%. This generous percentage applies to all qualified solar expenditures. The credit is set to decrease in 2033 (to 26%) and 2034 (to 22%), before being phased out entirely in 2035 unless Congress renews it. This makes 2025 an ideal year to install and secure the highest possible credit.

Who is Eligible to Claim the Tax Credit?

Eligibility for the solar tax credit is straightforward, but it’s crucial to meet all the criteria to ensure your claim is valid. You must be the owner of the solar system, and the system must be installed at a residence located in the United States. You do not need to be a homeowner; tenants of cooperative apartments or condominium members who contribute to a shared solar system may also be eligible.

It’s important to understand who does not qualify:

- You cannot claim the credit if you lease your solar panels or sign a Power Purchase Agreement (PPA) with a solar company. Under these arrangements, the company owns the system and is the one who claims the credit.

- Landlords who do not use the property as a residence cannot claim the residential credit.

- Your solar system must be new and being used for the first time. Used or repurposed systems do not qualify.

Does the Tax Credit Apply to a Second Home or Rental Property?

Yes, you can claim the solar tax credit for a second home, but with a very important condition: the property must be a residence that you live in for at least part of the year. The credit is not available for rental properties that you do not personally use as a residence. If the property is a “mixed-use” residence that you both live in and rent out, the credit may be prorated to reflect the percentage of time you use it for personal residential purposes. The IRS enforces this personal-use requirement strictly, so it’s always best to consult a tax professional for mixed-use scenarios.

Qualifying Solar Energy Property Costs for 2025

The 30% tax credit is calculated based on the total cost of your “qualified solar energy property.” This is not just the price of the solar panels themselves. A comprehensive list of what expenses you can include is essential for maximizing your credit. Every dollar you spend on these eligible items can save you 30 cents on your federal tax bill.

What Expenses Are Included?

- Solar PV Panels: The cost of the solar panels or photovoltaic (PV) cells.

- Labor Costs: All labor costs for on-site preparation, assembly, and original installation of the solar system are eligible. This includes expenses for permitting fees, inspection costs, and developer fees.

- Inverters: The cost of inverters, which convert the DC power from your panels into the AC power your home uses.

- Mounting Racks and Equipment: The cost of the mounting hardware and other necessary equipment used to secure the solar panels to your roof or ground.

- Wiring and Interconnection: The costs for wiring and piping needed to connect the solar system to your home’s electrical grid.

- Sales Tax: If your state and local governments charge sales tax on solar equipment, this can often be included in your qualified costs.

Is a Solar Battery Eligible for the Tax Credit?

Yes! Under the current federal law, a solar battery is eligible for the 30% tax credit. This is a game-changer for homeowners seeking energy independence and backup power. The battery does not have to be installed at the same time as the solar panels to qualify. You can install a standalone battery system and still claim the full credit, as long as it has a capacity of at least 3 kilowatt-hours (kWh).

What’s Not Included in Your Qualified Costs?

It’s just as important to know what you can’t claim. The credit does not apply to:

- General roofing materials or repairs. While your solar system is installed on your roof, only the solar roofing tiles or shingles that serve a dual purpose as both a roof and a solar energy collector are eligible.

- Appliance upgrades or other home improvements not directly related to the solar system.

- Interest payments on loans used to finance the solar system.

For a detailed breakdown of all qualified property costs, you should refer to the IRS Form 5695 Instructions. This official document provides the most accurate and up-to-date information directly from the source. It is the definitive guide for what you can and cannot claim.

Source: IRS Form 5695 Instructions

How to Claim the Federal Solar Tax Credit: A Step-by-Step Guide

Claiming your federal solar tax credit is a straightforward process that you’ll complete when you file your annual federal income taxes. Here is the step-by-step process, which is designed to be simple and easy to follow. You should consult with a tax professional to ensure you correctly apply these steps to your unique financial situation.

Step 1: Get Your Documentation Ready

Before you begin, gather all the necessary paperwork. This includes your contract with the solar installer, all invoices and receipts showing the total cost of the system, and any other documents that list the expenditures you plan to claim. It’s wise to keep digital and physical copies of everything in case of a future audit.

Step 2: File IRS Form 5695

This is the main form you will use to calculate your tax credit. You will complete IRS Form 5695, Residential Energy Credits, and submit it with your annual tax return (Form 1040). You’ll find sections to enter all your qualified solar energy property costs, including both the system and any eligible battery storage. The form will then guide you through the calculation to determine your credit amount.

You’ll enter the total cost of your solar system on Line 1 of Form 5695. For a system that costs $25,000, for example, you would enter that number. The form then instructs you to multiply this by the 30% credit rate on a later line to find your total credit value.

Step 3: Transfer the Credit to Your Tax Return (Form 1040)

Once you’ve calculated your total credit amount on Form 5695, you will transfer this value to your primary tax return, Form 1040. The specific line where you enter this amount can vary, but it will generally be transferred to Schedule 3, then to your Form 1040, where it will directly reduce your tax liability. It is a direct dollar-for-dollar credit against the tax you owe, not a deduction from your taxable income.

Remember that you must file your taxes for the same year that your system was “placed in service.” This generally means the year the installation was completed and the system was turned on and connected to the grid. If you purchased the system in late 2024 but it wasn’t installed until early 2025, you would claim the credit on your 2025 tax return.

Common Questions & Considerations

Navigating tax incentives can feel complicated, but having a clear understanding of the rules can save you from costly mistakes. Here are answers to some of the most common questions homeowners have about the solar tax credit.

What if I Don’t Have Enough Tax Liability?

A common concern is not having a large enough federal tax bill to claim the full credit in one year. The great news is that the federal solar tax credit is fully carryforwardable. This means if your credit is larger than the tax you owe, you can apply the remaining balance to future tax years. For example, if you have a $9,000 credit but only owe $6,000 in federal taxes, you would claim $6,000 in the first year and carry forward the remaining $3,000 to the next tax year.

Can I Claim Other Rebates with the Federal Tax Credit?

Yes! The federal tax credit can be combined with state incentives, utility rebates, and other local programs. However, the order in which you claim them is important.

- State and Utility Rebates: These are typically deducted from the total cost of your system before you calculate your federal tax credit. For example, if you have a $25,000 system and receive a $1,000 cash rebate from your utility, your federal tax credit would be calculated on a cost basis of $24,000, not $25,000.

- State Tax Credits: These do not affect your federal tax credit calculation, meaning you can claim both a state tax credit and the full 30% federal credit on your system’s total cost.

It’s critical to understand the rules of each program. Always check if a rebate is considered a direct payment that reduces your system’s cost basis for tax purposes. An experienced solar installer will be able to guide you on how these incentives work together in your specific state.

What About an Existing Solar System?

You can’t claim the solar tax credit on a system that was installed in a previous year. However, if you add a new solar battery to your existing system, you can claim the credit for the cost of the new battery in the tax year it was installed. Similarly, if you install additional solar panels on your existing system, you can claim the credit for the cost of the new panels and associated labor.

Navigating the Process: Professional Help vs. DIY

While the step-by-step guide can make the process seem straightforward, you may want to consult with a tax professional, especially if your financial situation is complex. Here are some of the benefits of working with a professional:

- They can help you determine your exact tax liability and whether you can take the full credit in one year or need to carry it forward.

- They can help you navigate complex scenarios, such as claiming the credit for a mixed-use property or a home that is also a small business.

- A professional can help ensure all your eligible expenses are included and that you are in full compliance with IRS rules, which can help in the unlikely event of an audit.

While the process is designed to be accessible to a do-it-yourself taxpayer, the peace of mind that comes from professional guidance can be a valuable investment, ensuring you maximize every dollar of your credit and avoid any costly mistakes.

The federal solar tax credit is a powerful incentive designed to make clean energy more accessible to every American. By understanding the eligibility requirements, qualified expenses, and the simple filing process, you can confidently claim a significant portion of your solar investment and accelerate your journey to energy independence. As you plan your solar project for 2025, remember that this valuable credit is a key part of your overall financial return. Don’t miss your opportunity to take full advantage of it.

Is the 30% Solar Tax Credit for 2025?

Yes, the 30% tax credit is available for all eligible solar systems installed and placed in service in 2025. It is scheduled to remain at this rate through 2032.

What is the Difference Between a Tax Credit and a Tax Deduction?

A tax credit directly reduces the amount of tax you owe, dollar for dollar. A tax deduction reduces your taxable income, which in turn lowers your overall tax bill. The solar tax credit is a credit, which makes it a far more powerful financial tool than a deduction.

Can I Claim the Solar Tax Credit on an Investment Property?

No, the residential clean energy credit is only available for a primary or secondary residence. It cannot be claimed on rental properties that you do not personally live in.

Is There a Limit to the Solar Tax Credit?

No, there is no maximum amount that can be claimed for the federal solar tax credit. You can claim 30% of your total qualifying expenses, no matter how large the system or its cost. The credit is also not limited by your income level, so all individual taxpayers are eligible to claim it.

You can also calculate your investment and returns by reviewing our blog post titled Solar Panel ROI Calculator.

Solar Energy Enthusiast & Renewable Energy Researcher

Vural’s journey into solar energy began four years ago, driven by frequent power outages and high electricity bills at his own home. He has since gained hands-on experience with both personal and commercial solar projects. At solarpanelresource.com, Vural shares his real-world insights and in-depth research to guide homeowners and business owners on their own path to energy independence.