How to Calculate the Payback Period for Your Solar Panel System

Investing in a solar energy system is a significant decision, and for most people, it involves a substantial upfront cost. This financial commitment can feel daunting, which is why understanding when that investment will pay for itself is absolutely crucial for sound financial planning. This is where a key metric called the payback period comes in.

As an energy professional, I can tell you that the payback period is one of the most important numbers you’ll look at. It quantifies the number of years required to recover the initial cost of your solar panel system through the energy savings and incentives you receive. This comprehensive guide will not only explain how to calculate this vital metric but will also clarify its relationship with your long-term Return on Investment (ROI) and shed light on the various factors that can influence both. This is an evidence-based analysis designed to give you the clarity you need to make a confident decision.

What Is the Payback Period in Solar Energy?

The payback period is the most important financial metric for any solar investment. Simply put, it’s the time it takes for the money you save on electricity to equal the total amount you spent on your solar panel system. This isn’t just about the cost of the panels themselves; it’s a comprehensive calculation that includes the inverter, all installation labor, permits, and every other balance-of-system component. Once your cumulative energy savings—from generating your own power and selling any excess back to the grid—surpass that total upfront cost, you’ve reached your payback point. From that moment on, every kilowatt-hour of electricity your system produces is a net financial return, essentially turning your system into a revenue-generating asset for the rest of its life.

What Is the Equation for Calculating Payback Time?

Calculating your solar payback period starts with a simple formula, but it’s important to understand the nuances to get an accurate number. The basic calculation is straightforward, almost deceptively so:

Payback Period (Years) = Total System Cost / Annual Savings

Let’s look at a clear example. If your solar system has a Total System Cost of $12,000 and your Annual Savings on electricity bills is $1,200, the simple math gives you a payback period of 10 years.

$12,000 ÷ $1,200 = 10 years

However, this simplified formula is just the starting point. As a financial expert, I can tell you this calculation doesn’t account for several critical variables that can dramatically change your result. For a more accurate and realistic number, you should use the net cost of the system after all tax credits, rebates, and other incentives. You also need to factor in the projected increase in utility rates over time and the slight annual degradation of your solar panels. Factoring in these details gives you a much better picture of your long-term return on investment. This more detailed approach is the professional standard for financial analysis of solar projects.

How to Calculate the Payback Period Formula (Step-by-Step)

Calculating your solar payback period can feel intimidating, but it’s a straightforward process when you break it down into a few key steps. As an energy consultant, this is the exact process I use to provide clients with a realistic and honest financial forecast.

Here’s how to get a more accurate number:

- Start with the Full Cost: Don’t just look at the panel price. Begin by calculating the total installed cost, which includes all equipment (panels, inverter, racking), labor, and any permit fees or soft costs. This is your initial investment.

- Factor in Incentives: This is a crucial step that can drastically shorten your payback period. Immediately deduct all federal, state, or local incentives from your total cost. For example, in the U.S., the federal Investment Tax Credit (ITC) can reduce your net cost by a significant amount.

- Estimate Your Annual Savings: Next, you need to determine how much money you’ll actually save each year. To do this, you’ll need two things: your system’s estimated annual output in kilowatt-hours (kWh) and your local electricity rate. Multiply your output by your rate to get a realistic estimate of your annual savings.

- Do the Math: Finally, apply the simple formula: Net Cost ÷ Annual Savings.

While this provides a strong estimate, for the most accurate results, you should use a dedicated solar payback calculator or spreadsheet. These tools can automatically incorporate more complex variables, such as regional sunlight data (irradiance), the slight annual degradation of your panels, and, most importantly, the future inflation of electricity prices. Factoring in these details is the professional standard for a truly reliable financial projection.

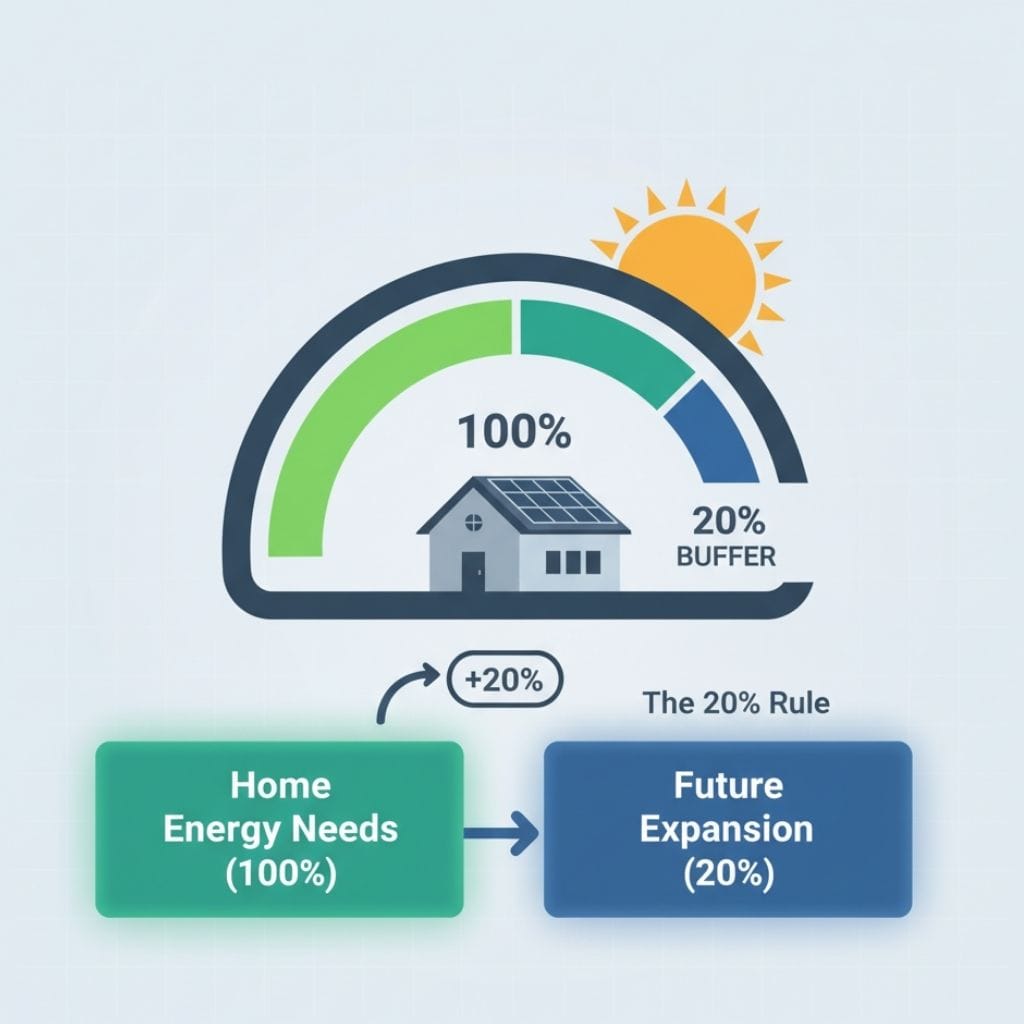

What Is the 20% Rule for Solar Panels?

The “20% Rule” is a common industry rule of thumb, but it’s a simplification you shouldn’t rely on for a final decision. The rule suggests that a solar system should offset at least 20% of your total energy consumption to be considered economically viable. While this number is somewhat arbitrary, it’s used as a quick screening threshold in some financing models and can even be a requirement for certain incentive eligibility programs. It serves as a starting point for a conversation, not a final verdict.

Ultimately, the economic viability of your solar project depends on a deeper analysis than a single percentage. In regions with high electricity costs, for instance, a system that offsets even a small portion of your consumption—say, 10% or 15%—may still yield excellent returns. The real factors that determine your payback period are the local cost of electricity, available incentives, and the system’s size, not an arbitrary rule of thumb. Always rely on a detailed financial analysis over a simplified guideline to make the best long-term investment.

What Is the Difference Between ROI and Payback Period?

The payback period and Return on Investment (ROI) are two sides of the same financial coin, but they tell very different stories about your solar investment. A payback period tells you when you’ll recoup your initial investment, while ROI tells you how much profit you’ll make in total over the system’s life. ROI is a more comprehensive measure of long-term profitability.

Understanding Your Return on Investment (ROI)

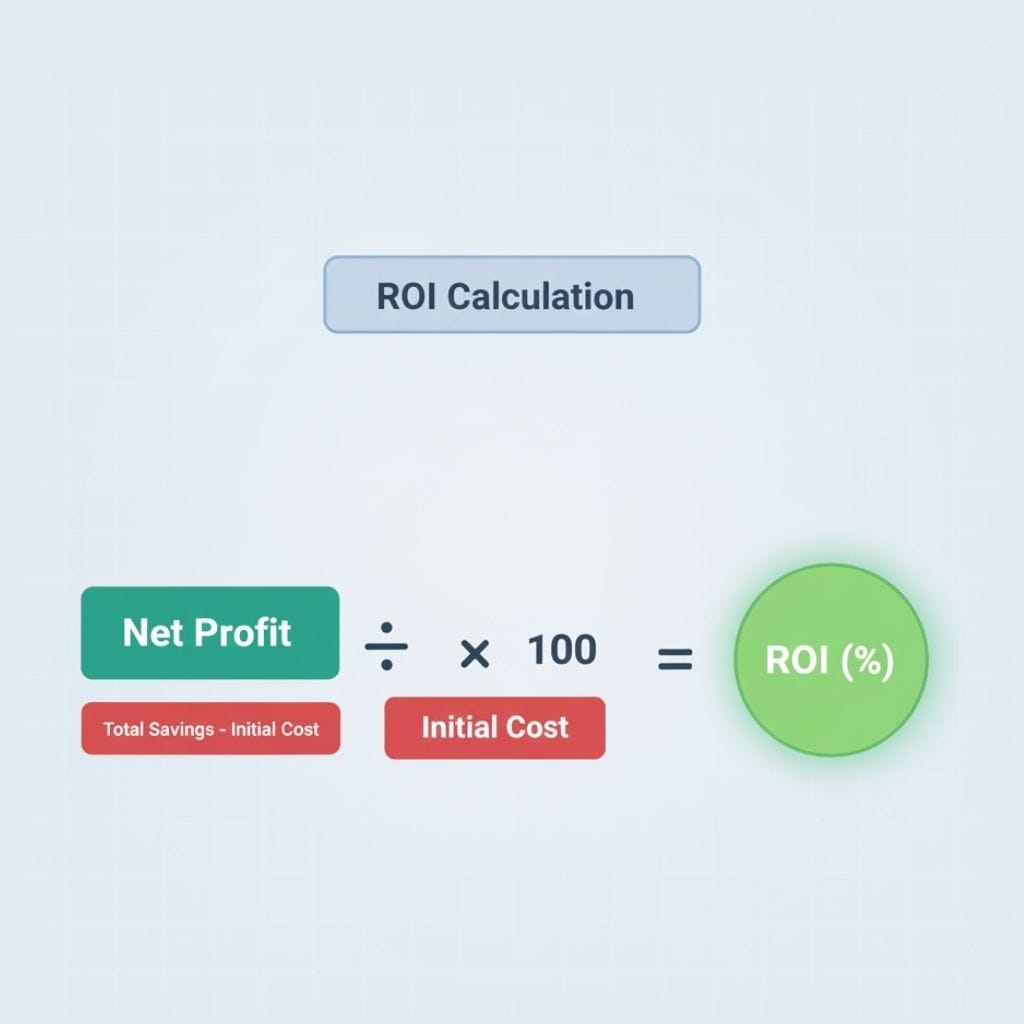

The ROI formula is a straightforward way to express your system’s total economic benefit as a percentage. It shows how much money you’ve made relative to your initial cost.

The formula is:

ROI (%) = (Net Profit ÷ Initial Investment) × 100

In this formula, Net Profit is your total savings over the system’s lifespan minus the initial cost of the system.

Let’s use a clear example: if your solar system costs $12,000 and generates $30,000 in total savings over its 25-year lifespan, your calculation would look like this:

Net Profit = $30,000 (total savings) – $12,000 (initial investment) = $18,000

Now, plug that into the ROI formula:

ROI = ($18,000 ÷ $12,000) × 100 = 150%

Unlike the payback period, which only focuses on the break-even point, ROI gives you a complete picture of the total financial value of your investment across its entire lifespan.

How Do You Calculate ROI for a Solar System?

Accurately calculating the true financial return on your solar investment requires looking beyond the simple payback period. For a realistic picture of your Return on Investment (ROI), you need to consider a few key factors that a basic calculation doesn’t include.

Factors for an Accurate ROI Calculation

- Total Energy Savings: The first step is to project the total energy savings you’ll realize over your system’s entire lifespan, typically 25 to 30 years. This requires an accurate estimate of your system’s output and your energy consumption.

- Electricity Price Inflation: This is one of the biggest drivers of solar’s financial benefit. Utility electricity prices consistently rise, and your solar system essentially locks in your power cost. You should factor in an estimated annual inflation rate for electricity to see how your savings grow over time.

- Maintenance and Replacement Costs: A solar system isn’t completely maintenance-free. You should budget for periodic cleaning and a major component replacement, such as the inverter, which typically needs to be replaced after 10–15 years. Accounting for these future costs provides a much more honest projection.

- Incentives and Tax Credits: Be sure to include all federal, state, and local incentives. These can dramatically reduce your upfront cost and accelerate your ROI.

Deeper Financial Analysis

For larger commercial projects or for those who want a more sophisticated analysis, most financial analysts prefer to use Net Present Value (NPV) or Internal Rate of Return (IRR). While these metrics are more complex, they factor in the “time value of money,” giving you a clearer picture of your investment’s value over its entire lifespan.ns.

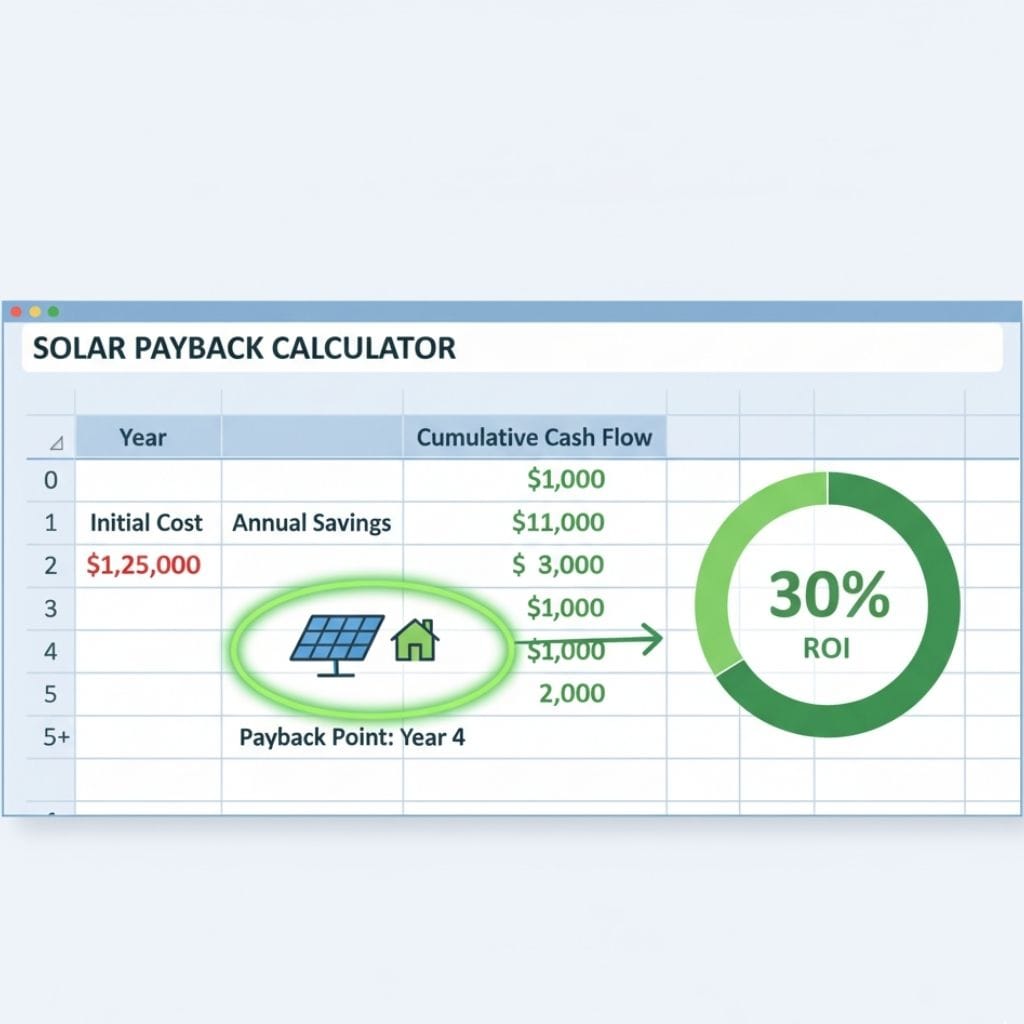

Can You Calculate Payback Period in Excel?

Yes, absolutely. Using a spreadsheet like Excel is an excellent, professional-grade way to calculate your solar payback period. While a basic calculator gives you a single number, a spreadsheet allows you to create a dynamic financial model that accounts for all the variables in your specific project. It puts the power of detailed financial analysis directly in your hands.

Building Your Payback Period Model in Excel

Here is a recommended structure that allows you to see a realistic and comprehensive financial picture:

- Column A: Year – Start with Year 0 (your installation year) and go all the way up to Year 25 or 30 (the lifespan of your panels). This forms the timeline of your investment.

- Column B: Projected Savings – This is where you calculate the savings for each year. This is a critical column where you can factor in the annual degradation of your panels and, most importantly, the projected increase in your utility’s electricity rates.

- Column C: Cumulative Savings – This column is the magic of the model. Each row adds the savings from the current year to the total from the previous years. This shows you exactly how much money you have saved over time.

To find the exact payback year, you can apply a simple conditional logic formula. For example, you can use =IF(CumulativeSavings >= InitialInvestment, "Payback Reached", "Still Paying"). This will clearly flag the year your investment breaks even.

Using a spreadsheet allows for easy adjustment of variables like annual electricity inflation, maintenance costs, or even changes in tax incentives. This is the professional way to go beyond a simple estimate and build a truly reliable financial forecast for your solar investment. You can even use the PVWatts Calculator by NREL to get a highly accurate estimate of your system’s output to use in your model.

What Is the Life of Solar Panels?

Modern solar panels aren’t just a purchase; they’re a long-term asset designed for decades of reliable performance. While some may worry about panels failing quickly, the reality is that the industry has made incredible strides in durability and longevity. Today’s Tier-1 panels typically come with a product and performance warranty for 25 to 30 years.

What’s even more impressive is how little they degrade over that time. According to trusted sources like the IEA PVPS and IRENA, most quality systems will still retain between 80% and 85% of their rated output after 25 years. This predictable, slow decline is a key reason why solar is considered such a safe, long-term investment.

Why Premium Panels Are Worth It

For those looking to maximize their return, premium modules offer even better performance. Panels with advanced technologies like N-type or heterojunction (HJT) cells have a significantly lower degradation rate, often guaranteeing over 87% output after 25 years.

What does this mean for your bottom line? A lower degradation rate directly translates to a higher long-term energy yield. This boosts your ROI and shortens your payback timeline, ensuring you’re generating more clean power and saving more money for a longer period of time. It’s a key factor that separates a good investment from a great one.

What Happens to Solar Panels After 20 Years?

Many people believe solar panels have a hard “expiration date” after 20 years, but that’s a common misconception. The reality is that solar panels are built to be long-term assets that continue producing electricity well beyond their warranty period. They don’t suddenly stop working; they simply become less efficient over time.

Understanding Panel Longevity and Degradation

This long lifespan is backed by industry standards and manufacturer guarantees. Most manufacturers offer a performance warranty that guarantees their panels will still produce at least 80–85% of their original rated output after 25 years. This gradual decline in performance is known as degradation, and it’s a natural process that all solar panels undergo.

The good news is that for high-quality, modern panels, this degradation is very slow and predictable. With regular maintenance and a professional installation that prevents things like micro-cracks or wiring issues, many systems can continue to operate and produce clean power for 30 years or even longer. In fact, some premium panels on the market today offer a 40-year warranty, a testament to the industry’s confidence in their longevity. Ultimately, a solar system is a durable investment that continues to pay dividends for decades.

Is Investing in Solar Panels Worth It?

Multiple studies confirm that solar investments provide substantial returns when systems are correctly sized and installed. Key advantages include:

- Reduced or eliminated electricity bills

- Increased property value

- Tax incentives and rebates

- Hedge against utility rate inflation

In regions with high sunlight exposure and net metering, the payback period may fall below 7 years, with 15–20% IRR over the system life. Even in cloudier areas, returns are competitive with traditional investments.

Common Misconceptions About Solar Payback Period

- Myth: Solar Panels Aren’t Profitable Without Full Off-Grid Setups.

- Fact: This is one of the biggest misconceptions in the industry. The reality is that grid-tied systems with net metering often achieve a faster payback period than off-grid systems. An off-grid setup requires a massive, expensive battery bank to store all the energy you need, which significantly increases the upfront cost and extends the payback period. In contrast, a grid-tied system uses the utility grid as a giant, virtual battery. Under a net metering policy, you get credit for any excess energy you sell back to the grid, allowing you to quickly offset your investment.

- Myth: The Payback Period Equals the Warranty Period.

- Fact: It’s a common fear that you’ll be paying for your solar system for its entire life, only for it to die right as it pays for itself. The truth is that many systems pay back their costs well before their warranties end. The typical payback period in most parts of the U.S. is between 6-12 years, far shorter than the standard 25-30 year performance warranty. This means that for a decade or more after your system is paid for, it continues to generate free electricity for you, turning it into a true revenue-generating asset.

- Myth: Only Sunny States Benefit from Solar.

- Fact: While states with a lot of sun, like Arizona and California, are great for solar, modern technology and smart incentives make solar viable in many temperate climates. Efficient panels are designed to perform well even on cloudy or overcast days. More importantly, many states with less sun offer generous state-level incentives or attractive net metering policies that drastically shorten the payback period. This is why solar is booming in places like Germany, which has less average sunlight than most of the U.S. The financial viability of solar depends more on your local electricity rates and incentives than on your geographic location.

The solar payback period isn’t just a number; it’s a vital metric for any serious investor considering a solar system. It’s the single most direct answer to the question: “When will I get my money back?” By accurately and realistically calculating your total costs and factoring in your anticipated energy savings, you can determine exactly when your system will break even and begin generating pure financial returns.

But the analysis shouldn’t stop there. For a truly holistic understanding of solar viability, it’s essential to consider your long-term Return on Investment (ROI), the remarkable lifespan of modern solar panels, and their consistent technical performance. With energy prices continuing to rise and the cost of high-quality solar modules in a long-term decline, the financial case for solar energy has never been stronger. Ultimately, an investment in solar is an investment in a more predictable and profitable financial future.

Click here to get more information about solar panels and check out our blog.

Solar Energy Enthusiast & Renewable Energy Researcher

Vural’s journey into solar energy began four years ago, driven by frequent power outages and high electricity bills at his own home. He has since gained hands-on experience with both personal and commercial solar projects. At solarpanelresource.com, Vural shares his real-world insights and in-depth research to guide homeowners and business owners on their own path to energy independence.